Jupiter, Florida, United States: Three of the past four years have seen new high-water marks for rounds played at golf courses across America. And the industry could be headed for another record-setting year in 2025.

But golfers aren’t just playing more, they’re also spending more time at golf facilities in general.

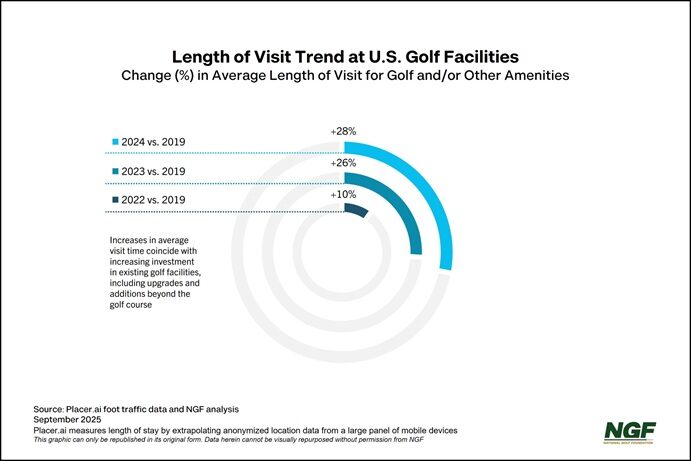

As golf courses continue to position themselves as destinations beyond just on-course golf – from practice and retail offerings to additional amenities and broader food and beverage offerings – the average length of stay has jumped 28% compared to six years ago (pre-Covid).

Researchers at the National Golf Foundation (NGF) worked with Placer.ai* to compile and analyse foot traffic data that reveals the average length of visit to golf course properties (for golf and anything else) continues to climb in recent years.

The increase in average visit times coincides with on-going re-investment in existing golf facilities, both public and private.

Golf courses and clubs thrived as safe havens shortly after Covid hit in 2020, as the game’s outdoor nature, generational appeal, and physical, social and emotional benefits were widely celebrated and embraced.

As the game’s popularity has continued to soar, many facilities have taken advantage of their healthier financial positioning by continuing to improve the overall experience. While this often starts with the most important product – the golf course itself – it extends to the clubhouse, practice facilities, restaurants and other F&B options, gym and fitness centres, tennis and pickleball, and other lifestyle-focused amenities.

The evolution highlights how more golf courses and clubs are becoming all-in-one destinations, as the visit data also reveals an increase in the proportion of those who go directly to a golf course from home, or from a golf course directly to their place of residence. In 2019, about 51% of visitors came to a golf course directly from home, and in 2024, that share jumped to 58%. Similarly, the share of visitors returning directly home from golf courses grew from 48% in 2019 to 51% in 2024.

Private country clubs which have a wide range of amenities for members and families impact this significantly. But the increase encompasses all US facilities – about 75% of which are open to public play.

On the private side, data NGF has compiled in partnership with Players 1st# reveals a notable increase in weekly use of fitness facilities and pickleball, in particular.

Given the substantial increases in play – not to mention participation upticks among beginners and younger cohorts – one might think that slower play (and longer rounds) could be a contributor to lengthier course visits. But NGF and Players 1st surveys (of public course golfers) refute that potential cause, with pace-of-play satisfaction ratings increasing by about 2% in recent years.

The Placer.ai foot traffic findings are more an affirmation of the evolution of the modern golf facility. They speak to potential investor and entrepreneurial opportunity in facilities that offer more than just golf – public or private. They also reveal the importance of building bonds, including emotional connection, to the game that goes beyond simply traditional on-course participation.

*Placer.ai is a location intelligence company that analyses foot traffic and other geo-spatial data to provide insights into consumer behaviour and market trends in the physical world. Their solutions aggregate anonymised location data from mobile devices to help businesses and other organisations make informed decisions.

#Players 1st is a leading supplier of Customer Experience solutions specifically designed to help golf course operators improve business results. Players 1st and NGF recently launched a joint product called GolfersVoice, a tool used by public golf facilities to monitor customer feedback and discover actionable golfer insights.